By Alan Lewis and Dan McKone

The following article was first published as L.E.K. Consulting Executive Insights’ Volume XV, Issue 19 on August 28, 2013.

Imagine there was a way to grow your profit line and create shareholder value by investing less money, taking less risk, seeing the benefits almost immediately and also making your customers happier in the process. In this article, L.E.K. Consulting Managing Directors Alan Lewis and Dan McKone lay out a new strategy that offers to do just that.

It is a familiar business mantra: “Focus on your core.” However, core markets inevitably mature, product growth inevitably slows and companies are eventually motivated to look for growth in often far-flung places. But in scanning the horizon for new markets and new products, companies overlook an enormous, untapped source of profit that exists in the near-field – on the edge of the core business through the sale of ancillary goods and services that actually make a customer’s interaction with the business more complete. In our work, we have observed that it is often the periphery of core businesses, rather than the core itself or some distant horizon that glows with opportunity.

Some industries discovered the power of edge offerings long ago – movie theaters are in the business of selling movie tickets, but for years have made most of their profit from high-priced popcorn and other concessions that enhance the movie-going experience. Companies in industries as diverse as financial services, cable operators, retail and hospitality have all had some degree of success in driving edge strategies into their businesses by selling things that could be viewed, stand-alone, as only obscurely related to their core solutions.

This is not to say that the core of a business is not important. It is crucial. Only by executing well in your core will your customers give you permission to play at the edge; but the economics that can be realized there often trump those captured in the base business.

In this opening installment of a series, we describe an Edge Strategy™ mindset and what sets it apart from more traditional strategic approaches. We explore how new technology that allows businesses to learn more about what their customers want and are willing to buy has made playing on the edge easier than ever before. And we argue that in the 21st century, companies that use an Edge Strategy approach to discover ancillary business opportunities will grow their profit line and create shareholder value while investing less money, taking less risk, realizing benefits sooner and keeping customers happier.

Finding the Edge

The edge exists immediately adjacent to a core business, in that place where the base offer would leave some customers dissatisfied. Often defined as options, extras and customizable variants, the edge can either be greater customization of the core or a way to add value to the core with a completely different, albeit complementary, product or service. Automobile companies countered modest economics on their basic product with high-margin extras and packages. Telecoms sold “value-added services” (remember when call-waiting and caller ID were extras?) at extremely high margin and then eventually rebundled them into plans that motivated the typical subscriber to trade up. Retailers in categories with razor thin margins (e.g., consumer electronics) found that they could generate strong profits selling warrantees and other services.

For others, the revelation has been more recent. In the late- 2000s, airlines looked beyond their core business of transporting passengers between airports to sell customizable choices around baggage needs, seat comfort and a variety of flexibilities and premium offerings. While many consumers balked at being forced to “choose” how much luggage to check, others were delighted that they could buy extended legroom, gain quick access though security and/or purchase a higher quality meal. Importantly, the end result has been U.S. airlines alone realizing billions of dollars of incremental profit through these edge offers; quite literally the difference between creating and destroying value for shareholders.1

Why the Edge is so Powerful

Most corporate mission statements and strategies attempt to answer some variation of the question: “What are we best at?” Firms tend to answer this question – and base their entire identities – in reference to their foundational assets. An asset base can take the form of hard assets such as a fleet of airplanes, or a chain of retail stores. Or it can take the form of more intangible assets such as smart employees or strong intellectual property around a given skill base.

These foundational assets are important. They help form the barriers to entry a company fosters to protect its market share. In most cases these assets are the basis of how companies compete and seek to differentiate themselves from rival companies; they are the tools of the (win-lose) competition at the core of most corporate strategies today.

Players who invest early and well – or perhaps are a bit lucky – can capture a dominant position in their market that then creates the platform to sustain this advantage, returning the cost of capital and keeping shareholders happy. These are the core strategy winners, the exceptional performers. The problem is that, by definition, this route to success doesn’t apply to most companies.

Few companies are able to sustain core dominance over the long term and for most (if not all, eventually) the inherent value of their foundational assets is rarely fully realized. Despite their complexity, foundational assets are typically built to execute on a relatively narrow set of activities – delivering the core offering of the company and, ideally, doing so better than competitors.

But companies that have the imagination to look beyond their core business to near-field edge offerings will discover new and lucrative ways to further monetize their core assets. Doing so requires focusing not on the question “What are we best at?” but on the equally important “What should our solution include?” This takes us from a framework that is competencies based (inward out) to one that is needs-based (outward in) and much more naturally centers on the customer, the absolute key to any profit-expansion effort.

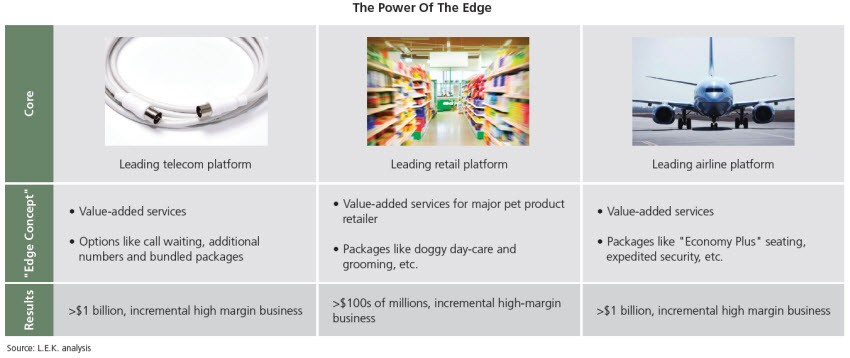

Many companies in a range of industries have successfully exploited the edge (see Figure 1 below). Uniting these disparate successes are some common threads. Some of our (sometimes surprising) observations about edge strategies include:

- The margins for edge offerings are often higher than those of core revenues. This is because they leverage existing resources, and also because captive customers tend to be less price sensitive to edge offerings. Think of the price of a soda at a movie, or in a hotel mini-bar.

- Edge offerings often address a greater number of fragmented customer needs, increasing the overall value proposition of the core offering for each unique customer.

- The additional revenue is often incremental to not only the company but also the market – put another way, a company doesn’t necessarily have to capture edge revenue from competitors.

- In some instances companies should welcome competitors adopting these ideas, as this helps condition the customer to the new offers.

- Since incremental edge offerings target unmet customer needs, they not only create incremental profit streams but also often have a significantly positive impact on customer satisfaction.

- Even initiatives that only impact a small proportion of a customer base can be transformational for the profitability of the company. Take the fuel option that Hertz and other rental car companies offer: A tiny portion of customers take this option, yet it is a significant profit stream for these companies.

- Edge strategies can accumulate many smaller (even modest) elements to create significant sources of strategic advantage – allowing proactive companies to incrementally build powerful differentiation.

Why the Edge is Low Risk

An Edge Strategy approach is accessible. Compared to similarly disruptive innovations in the core, it often requires a relatively smaller incremental capital investment or allocation of resources. Responses by competitors are typically less head-on and, as suggested before, can even help in conditioning customers. Unlike many other bold strategies, edge initiatives often do not require a company to place major risks on its core business. While it can be transformational to the bottom line, an Edge Strategy mindset doesn’t necessarily need to redefine the company.

Let’s compare it to some popular growth strategies. All are valid and exciting growth paths, and we have recommended many, in various circumstances, to our clients. But we always add the caveat that they can be extremely hard to get right.

- Attempting to capture value by creating a whole that is greater than the perceived sum of its parts might be tempting on paper, but it has a woeful record. A variety of studies, including one recently performed by L.E.K. Consulting, has found that most mergers destroy shareholder value; in only 20-40% of deals do two companies end up being worth more together than apart. Mergers are also expensive, often all-consuming, and difficult to reverse.

- New markets or new channels. Many growth strategies focus on augmenting a core business by expanding into new markets or new channels – but rarely are these new opportunities without steep learning curves or tough incumbent competitors.

- “Blue Ocean” opportunities. Attempting to create new demand in an uncontested market requires a company to foster winning capabilities in a totally new arena and understand new and unfamiliar customer needs – a considerable challenge that is easy to underestimate.

- The Innovator’s Path. True disruptive plays are few and far between and only a very rare set of companies (try to name 10!) have demonstrated a sustainable track record of success on this path.

An Edge Strategy approach does not preclude forays into these avenues; instead, this approach tends to amplify a company’s chosen core strategy by enriching the customer solution. It also presents a management team with a valuable path to deliver bottom-line improvement with less risk, lower investment and typically shorter timelines.

Enabling the Edge: Why Now?

Many companies are staring at untapped potential: Knowing your edge potential has become a strategic imperative. Emerging consumer trends, enterprise technology, and ever-more competitive global dynamics mean that there has never been a better time for management teams to look toward the edge. Vast improvements in the ability to capture, rapidly analyze and disseminate data as well as advances in the technology of targeting and merchandising, mean that companies can effectively fulfill the needs of smaller and smaller cohorts of customers. This makes edge offerings an essential component of fulfilling the personalization strategies that many consumer facing companies are eager to adopt.

In an upcoming series of articles we explore this topic in more detail by providing further examples; detailing considerations for how to go about defining your Edge Strategy approach; explaining when to bundle offerings versus unbundle; outlining how to activate an Edge Strategy plan; and laying out perspectives for how leaders in various industries can weave the edge into their plan.

Understanding your organization’s corporate identity is critical, but doing so in direct reference to foundational assets can also be dangerous. It can lead to a centripetal focus that leaves all but the absolute market leader highly exposed. Additionally, embarking on expensive adventures to grow beyond the core carries high risk. By contrast, companies that look to the periphery of their core business in search of ancillary offerings may find many more profitable niches and, in the process, discover a winning edge.

1 Ancillary revenues delivered $10B of high margin revenue for the top three U.S. airlines alone in 2012, grown from a negligible base six years ago. (Source: Ideaworks, Review of Ancillary Revenue Results for 2012).