By Alan Lewis and Dan McKone

The following article was first published as L.E.K. Consulting Executive Insights’ Volume XVII, Issue 4 on February 17, 2015.

When growth slows, many companies look beyond their core business. But in scanning the horizon for new markets and new products, they often overlook an enormous, untapped source of profit that exists in the near field. By adopting an Edge Strategy™ mindset, you can exploit this source of profitable growth.

As we detail in our upcoming book, one of the ways a company can employ an Edge mindset to great success is when it considers the “edge of its enterprise.” A strategy at the edge of the enterprise recognizes that some of a company’s existing assets, capabilities and resources can be readily deployed as new offerings for new customers without significant investment. These opportunities tend to occur when a company generates by-products, possesses unconstrained assets or has some form of spare capacity. Our research indicates that across virtually all industries, you can find companies tapping these types of opportunities to access incremental sources of profit with new customers.

In this article, L.E.K. Consulting Managing Directors Alan Lewis and Dan McKone discuss the rapid growth of Airbnb within the broader context of the sharing economy; assess the threat it poses to traditional hotel brands; and show how these companies can employ an Edge mindset to beat Airbnb at its own game.

The Sharing Economy

Companies that operate in the sharing economy don’t own assets and don’t provide services directly to consumers. Rather, they function as third-party clearinghouses, enabling property owners and individuals to monetize their unused assets and time. Examples include TaskRabbit for sourcing odd household jobs to people, like students, with the spare time and willingness to trade this for incremental cash; DogVacay for connecting people with pet friendly homes to pet owners in need of pet-sitting; Spinlister lets bike owners rent out their bikes when they are not using them; and companies like RelayRides and Getaround facilitate car-sharing.

Two of the best-known players are in the travel and tourism industry: Uber for taxi services and Airbnb for rooms. Both are causing significant disruption, dramatically reorienting consumer behavior and expectations, and challenging existing regulatory frameworks.

Overview of Airbnb

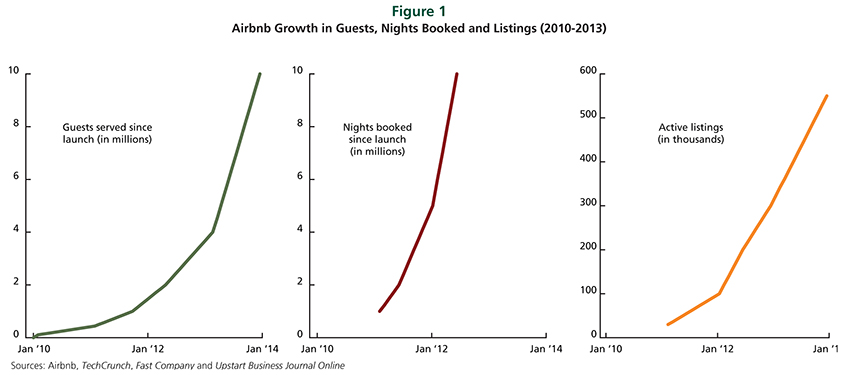

Since its founding in San Francisco in 2008, Airbnb has grown at a staggering pace. Now a global enterprise, it offers 800,000 listings in more than 34,000 cities in nearly 200 countries. Cumulative guest stays have more than doubled year by year and recently surpassed 20 million. Airbnb’s valuation has soared to an estimated $13 billion — more than traditional hoteliers Hyatt, Wyndham and InterContinental.

The business model is disarmingly simple. Airbnb hosts the website, provides 24/7 customer support, vets property owners and guests for safety, and oversees a peer-review system. Everything else — cleaning services, key exchange, not to mention the actual rooms, apartments and houses themselves — is out of their hands. It charges both parties a percentage on the room rate: 3% to hosts, and 6-12% to guests.

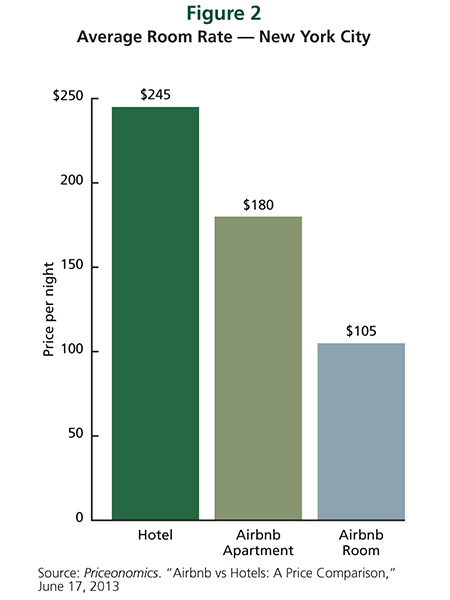

Originally Airbnb catered exclusively to budget travelers, mainly tourists, but not anymore. These days you can book a castle on Airbnb, or even a private island. Business travel remains a tiny percentage of Airbnb’s business but it is growing exponentially, thanks in part to two recent developments: (1) Airbnb’s new dedicated portal for business travelers and (2) its partnership with Concur, whose Triplink travel management system is used by 70% of Fortune 100 companies. The Concur deal allows employees for the first time to bill rooms booked through Airbnb directly to their companies.

The Threat

Should traditional hoteliers be worried? Bill Carroll, a marketing professor at Cornell University’s School of Hotel Administration, is among those who spoke recently to Fast Company magazine, and who believe the threat is overblown. He decried the “hoopla” surrounding Airbnb and said, “It’s always going to be a niche service.” Industry reaction is mixed. Some hoteliers and hotel companies have publicly declared Airbnb as a different proposition to theirs and don’t view the model as competitive. Others are less sanguine and not only recognize the threat but argue they can see the impact in their revenue figures.

To be clear, we think Airbnb is a real threat to traditional hotel brands. As they grow and adapt to shifts in market trends, these types of sharing models will become more and more acceptable to core hotel guest segments. Hotel brands ignore this threat — or label it a different business — at their peril.

Edge Perspective

While the focus of attention on Airbnb is its role as a disruptive channel, its impressive valuation is likely built on the expectation that Airbnb is an “eyeballs” play like the darlings of the social media world. While this may be in part valid, we actually think if you view Airbnb with an Edge mindset, you can see a different business at work.

As we’ve defined elsewhere, edges are boundaries between core and non-core. They reflect the tremendous operational leverage from exploiting resources and capabilities that have already been acquired or developed; plus, edges offer the exciting marginal economics of doing a bit more with what you already have. Airbnb, like Uber, is availing itself of Edge Strategy. Their innovation is that they are making use of someone else’s spare capacity, their underutilized assets: their “edges.”

Furthermore, one approach to Edge Strategy is considering how you can leverage your existing assets to unlock new sources of revenue without significant incremental investment – we call this an “enterprise edge.” Any company that recognizes how it can monetize the under-used or spare aspects of its assets and resources is using an Edge mindset.

The brilliance of Airbnb as a model, in our view, is that it aggregates the spare capacity of these many individuals’ properties into a viable lodging offering. They spotted that individuals have real estate assets and just like any company, these assets are not fully utilized. All they needed was a partner to provide a brand to market under and a channel to book through. Now that sounds like a familiar model.

We think the more instructive way to view the disruption of Airbnb is from the development lens. Airbnb is essentially fulfilling the same job as a hotel company, just accessing its real estate from a new source.

Disrupting Development Strategy not Channel Strategy

If traditional hotels were to compete with Airbnb not on the consumer side but on the development side of the business, then the game may switch back in their favor. Consider some of the challenges Airbnb faces with both of its constituents, hosts and guests.

For guests, the diverse opportunity to access unique lodging experiences may be compelling to some — especially millennials — but for other potential guests, this equates to uncertainty and anxiety.

For hosts, again while many may be comfortable with trading income for access to their homes, this is a risky step into the unknown that surely limits the available pool of inventory.

We should then factor in the strengths that a typical hotel brand can bring:

- Power of loyalty: Databases of relationships with thousands of loyalty program members

- Marketing presence: Strength of their brands

- Established infrastructure: CRS and channel management, third-party channel relationships and presence, customer service capabilities

- Existing inventory: To support in cities with additional facilities such as spas, gyms and restaurants

- Supply chain capabilities: To support the provision of amenities and cleaning services

It is precisely what makes a hotel brand successful that can be a differentiator in competing directly with Airbnb at its own game. We contend that all hotel companies should be exploring how they can launch a competing brand to Airbnb in offering a hosting model.

One Spanish hotel chain, Room Mate Hotels, is experimenting with exactly this strategy under a new brand, Be Mate. Launched in September 2014 across 10 cities in Europe and North America, Be Mate promises “unique apartments with hotel services.” It partners with landlords who own apartments close to Room Mate hotels, offering access to its booking channel and a range of hotel services for guests, including all those mentioned above plus meeting rooms and airport transfers. Room Mate says it will use the same channel to enter markets where it’s not already operating by contracting with other hoteliers to provide services to Be Mate guests.

Conclusion

Traditional hoteliers have two choices about how to respond to the rapid, widespread and fundamentally disruptive threat posed by Airbnb. They can ignore it and risk losing existing customers to the new model as it evolves and continues to gain share in segments beyond the millennial vacationer. Or they can face it head on, deploying their hosting model and brand that capitalize on their core competencies and expand the dimensions of the evolving sharing economy.